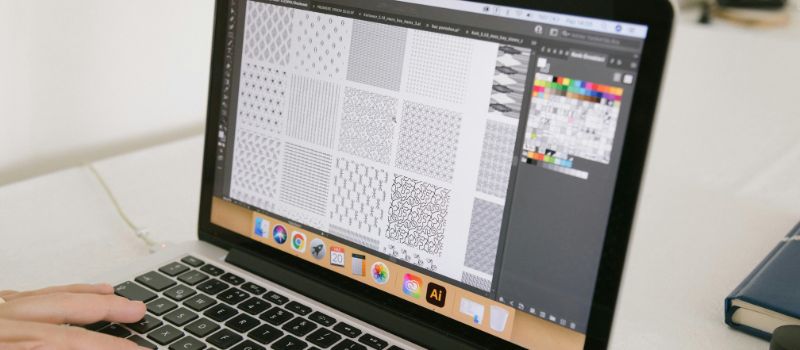

Illinois Sales Tax Graphic Arts Exemption

Recent Victory in Sales Tax Dispute

In a recent victory, our Firm was able to reduce our client’s liability by about $19,000.00 after a failed Informal Conference Board hearing.

Basis for the Exemption Argument

The Taxpayer argued that its website graphic design activities constitute “graphic arts production,” as both the Illinois statutes and the applicable regulation make engaging in graphic arts production a condition precedent to qualification for the graphic arts exemption.

Showing that the Taxpayer is engaged in “graphic arts production” is a statutory and regulatory prerequisite to establishing that the Taxpayer’s computers, software, and other items qualify for the graphic arts exemption.

NAICS Classifications and Interpretation

The NAICS classifications enumerated in the statute and regulations pertaining to the graphic arts exemption cover only various methods of printing and print production, and services directly related to these activities.

Section 130.325(b)(1)(C) underscores this limitation, stating:

“The exemption applies to machinery and equipment used in graphic arts production processes, as those processes are described in the NAICS. While the NAICS subsectors referenced in subsection (b)(1)(A) describe types of graphic arts establishments that typically engage in graphic arts production, the exemption is not limited to qualifying machinery and equipment used by the establishments described in the NAICS, but rather, to qualifying machinery and equipment used in the printing processes described in the NAICS (for example, lithography, gravure, flexography, screen printing, quick printing, digital printing and trade services such as prepress and binding and finishing services).”

Get Help With Your Audit

Contact our office to learn more about your audit and if this exemption applies to your business.

Phone: (888) 577-1482

Frequently Asked Questions

What is the Illinois Sales Tax Graphic Arts Exemption?

The Illinois Sales Tax Graphic Arts Exemption allows qualifying businesses engaged in specific types of graphic arts production to purchase certain machinery and equipment free from sales tax. The exemption applies specifically to items used in printing processes outlined in the NAICS classifications, such as lithography, digital printing, and related services.

Does website graphic design qualify for the Graphic Arts Exemption?

Generally, website graphic design does not qualify for this exemption. The Illinois statute and regulations focus on tangible printing and production methods defined by NAICS codes. However, there can be arguments made depending on how the design services relate to production processes that fit these categories.

What types of equipment are typically exempt under this rule?

Equipment used directly in the printing process, such as printers, presses, binding machines, and prepress tools, may qualify for exemption. Computers and software may also qualify, but only if they are demonstrably used in the specified production processes.

How can a business prove it qualifies for this exemption?

A business must demonstrate that its activities align with those outlined in the NAICS classifications for graphic arts production. Supporting evidence might include documentation of business operations, industry classifications, and how specific equipment is used within those processes.

How can the Ansari Firm help with sales tax audits and exemptions?

The Ansari Firm can evaluate your business operations, help determine eligibility for exemptions, and represent you during audits and disputes. They recently helped a client reduce liability by $19,000 through these services. Contacting them early in the audit process increases the chances of a favorable outcome.