Overview

If your store or restaurant is being audited by the Georgia Department of Revenue (DOR), you need to understand the distinctions between cooked food, uncooked food, and grocery items.

If you are selling all three types of items, it’s essential to separate these transactions clearly on your sales invoices and cash register. Failure to do so may result in the auditor grouping all sales into taxable sales and applying sales tax to your entire gross sales. Add penalties and interest, and you may face a significant sales tax liability.

Georgia’s Tax Exemption on Food

Georgia does not require sales tax on food, but this exemption does not apply to local (county, city, etc.) taxes.

Further, the exemption for “food and food ingredients” excludes:

- Prepared food

- Alcoholic beverages

- Dietary supplements

- Drugs

- Over-the-counter drugs

- Tobacco

Our Audit Story

Background

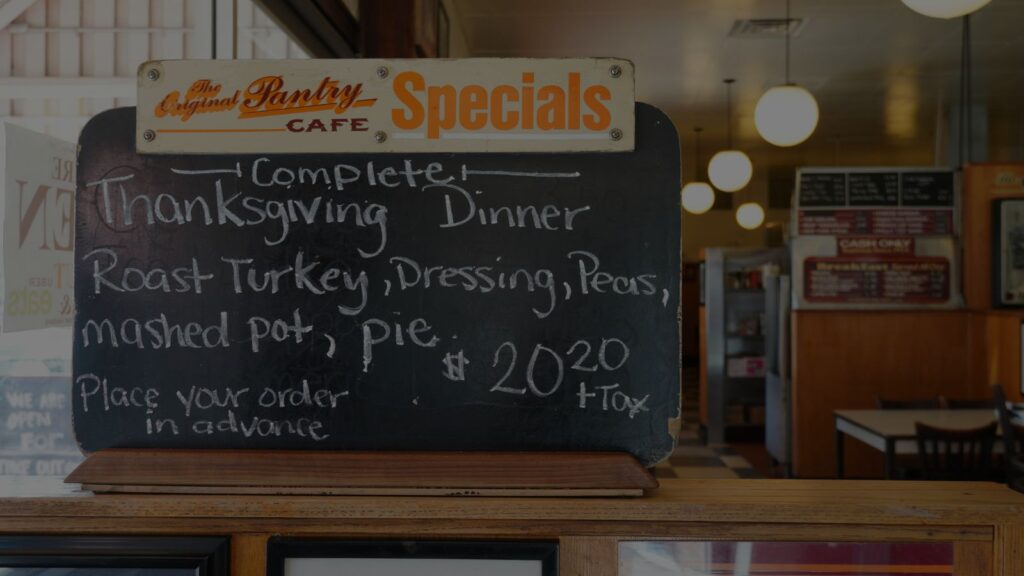

We have a client who runs a meat market and recently opened a restaurant at the back of his market. The food is outstanding.

However, the DOR is auditing his books and records, and the client did not separate his cooked food receipts from the meat market receipts.

He contacted our office, and now we are working to break down and defend his sales tax audit.

Key Considerations

- Cooked food is subject to the regular sales tax rate of the state, plus any local tax rates.

- The state will not make exceptions in your favor during an audit.

Understanding Sales Tax

Sales tax applies to purchases of goods and services. The rate varies from state to state. Money collected through this tax is considered a consumption tax.

In retail stores, prices on merchandise are typically shown before applying sales tax.

Frequently Asked Questions

What food items are exempt from Georgia state sales tax?

Georgia exempts most “food and food ingredients” from state sales tax. However, this exemption does not apply to prepared food, alcoholic beverages, dietary supplements, drugs (including over-the-counter), and tobacco products.

Are local sales taxes still applied to food in Georgia?

Yes, even though the state does not apply sales tax to qualifying food items, local jurisdictions such as counties and cities may still impose their own sales taxes on food.

Why is it important to separate cooked and uncooked food sales on invoices?

Failure to distinguish between cooked (taxable) and uncooked (exempt) food on invoices or register receipts may lead the Georgia Department of Revenue to treat all sales as taxable. This can result in inflated tax assessments, penalties, and interest.

How is cooked food treated differently in sales tax audits?

Cooked food is fully taxable at the standard state rate, plus any applicable local tax rates. During an audit, failure to account for it separately can significantly increase your assessed tax liability.

What should businesses do to prepare for a Georgia sales tax audit?

Businesses should clearly separate transactions for cooked food, uncooked groceries, and non-food items. Maintain detailed records and properly configured registers to avoid grouping errors that may lead to excessive tax assessments.