Does the Letter from the IRS Mention a Lien or a Levy?

Understanding IRS Liens and Levies IRS Tax Lien: A Claim Against Your Property Let’s start with the property you own. A Lien is a claim registered against property for not paying taxes. IRS Tax Levy: A Seizure of Your Property A Levy comes after a Lien has been filed. How the IRS Executes a Tax […]

USDA Food Stamp Fraud Attorney Atlanta

Increased USDA and SNAP Violation Charges in Atlanta If you are a grocery or convenience store owner in Atlanta, you should be on high alert for 2017 regarding USDA and SNAP violations in Atlanta. We have noticed a higher-than-usual call volume related to such charges. USDA inspectors often write you up on charges they find […]

SNAP Violation Attorney Atlanta

Protecting Your Business from License Revocation Having your business license revoked is worse than never having had one in the first place. The problem now is that you have a large payroll, rents, and have become used to earning a certain level of desired profits. Our clients have had liquor licenses, lottery licenses, and even […]

Donald Trump Tax Returns Loss Carry Forward

The loss carry forward method of realizing tax relief is absolutely legal and rewards entrepreneurs for risking their wealth for future growth. Think of how much more you can do with your money if you did not have to pay any tax next year? You would be about 16% to 45% wealthier based on your […]

Georgia Voluntary Disclosure Sales Tax Attorney

Understanding Voluntary Disclosure in Georgia If you are a business owner in the State of Georgia and want to know how to come forward with a Voluntary Disclosure of unreported or underreported sales tax, then you may want to read this blog. Most of our clients are not as worried about paying the underlying tax […]

Georgia Alcohol Sales Tax Audit

Overview If you are involved in the retail sale of alcohol in Georgia, there are sales tax rates you must keep in mind when doing business. Under audit, you will need to differentiate between the sale of distilled spirits, wines, malt beverages, and beers. If you own a retail outlet such as a convenience store, […]

Georgia Unstamped Cigarette Smuggling Attorney

Introduction Who hasn’t thought of this one? Seriously – when you are a store owner you would love to buy cigarettes for less and sell them for more. In most cases, we have a situation where a “mule” will carry cigarettes over state lines and is then stopped as soon as they cross over the […]

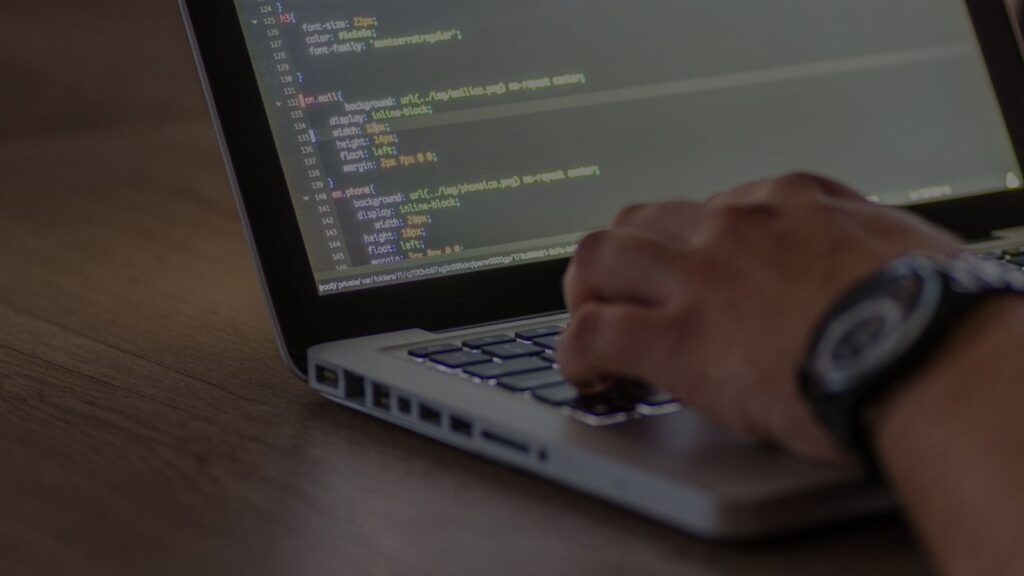

Georgia Sales Tax on Software and Maintenance Programs

Canned Software – Delivered on Tangible Media TAXABLESales of canned software delivered on tangible media are subject to sales tax in Georgia. Canned Software – Downloaded EXEMPTIn the state of Georgia, any documentation created must show the method utilized for delivery. If software is delivered both electronically and through the use of a tangible medium, […]

Illinois Sales Tax on Software and Maintenance Agreements

Software and Maintenance Agreements Taxability of Software Sales Maintenance Agreements for Tangible Personal Property Software Maintenance Provisions Labor Charges When calculating the Retailers’ Occupation Tax: Transportation and Delivery Charges Legal Precedent: Kean v. Wal-Mart Stores, Inc. Separability of Charges Department Clarifications Documentation Requirement:Sellers must maintain documentation demonstrating the customer had the option for pickup. Separately […]

Illinois Sales Tax on Hygiene Products

Repeal of the “Tampon Tax” Illinois joined a handful of states and the city of Chicago in repealing a so-called “tampon tax” as Gov. Bruce Rauner approved a bill that exempts feminine hygiene products from the state sales tax. Previous Tax Classification Currently, tampons and sanitary napkins are taxed by the state of Illinois as […]