Illinois Cigarette Sales Tax

Chicago, Illinois: Cigarette Sales Tax Expanded Definition of “Cigarette” (Effective July 1, 2012) Beginning July 1, 2012, the definition of “cigarette” was expanded to include: “Any roll for smoking made wholly or in part of tobacco labeled as anything other than a cigarette or not bearing a label”, if it meets two or more of […]

Small Business Attorney Chicago

Small Business Attorney in Chicago – Why You Need One! In the past, I have written articles on issues such as buying a business, selling a business, taxes, and corporate structuring. Given the current state of the economy, specifically in Chicago, there are even more reasons why you want an experienced business and tax attorney […]

Chicago Illinois Sales Tax Fraud

Overview of Sales Tax Fraud in Chicago, Illinois If you have been charged with sales tax fraud, contact our office and speak with a sales tax fraud attorney in Chicago. Sales tax fraud is intentionally avoiding sales tax payment by destroying, concealing, or tampering with records. House Bill 5289 increases the minimum penalty for sales […]

Chicago Illinois Strip Club Tax

Overview and Purpose of the Law Is there a link between violence against women and strip clubs? Is it fair? Is it penalizing? Who pays? How much will a club have to pay? Is it an official sales tax enforced by the Illinois Department of Revenue? These are all questions taken into consideration by the […]

Illinois Gas Station Sales Tax Fraud Attorney Chicago

Sales Tax Duties for Gas Station Owners As a gas station owner in Chicago, Illinois, you have duties to report your sales tax collected, like any other retail business. Over the last two years, the Attorney General has been coming down hard on unremitted sales tax. Over the last year, they went from imposing civil […]

Criminal Sales Tax Attorney in Chicago Illinois

Criminal Sales Tax Evasion in Chicago, Illinois To further explain the criminal enforcement of criminal sales tax violations, please see below for the new law broken down and explained in parts. This will help in understanding the new legislation. You can refer to the definition of ROT below to help in understanding the new amendment. […]

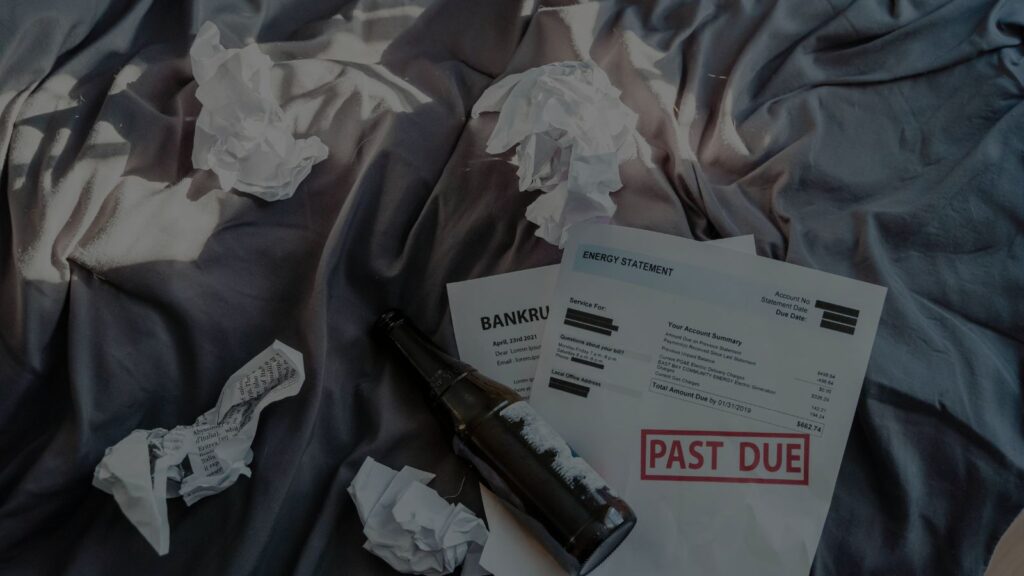

Chapter 11 Bankruptcy Attorney for Illinois Sales Tax

Filing Chapter 11 Bankruptcy for Illinois Sales Tax If your Illinois sales tax certificate of registration has been revoked in the Chicagoland area and the IDOR has rejected your installment agreement, Chapter 11 Bankruptcy may be your only option. A payment plan for unremitted sales tax is usually your only bite at the apple. Once […]

Illinois Sales Tax Voluntary Disclosure Attorney

Voluntarily Disclose for Unreported and Underreported Illinois Sales Tax The Sales Tax Problem Many Business Owners Face Most business owners are honest, hardworking people who fully intend to make the money back in a few weeks or possibly catch up with next month’s sales tax return. Before long, a taxpayer can find themselves several months […]

Are Services Subject to Illinois Sales Tax?

Are Both Products and Services Subject to Illinois Sales Tax? Question: Why is it that when Nancy buys nail polish she pays sales tax, but when she gets a manicure she does not have to pay sales tax? Answer:In the first scenario, Nancy is buying a product, so the store owner is responsible for collecting […]

Illinois Sales Tax Underreporting

Illinois Sales Tax Fraud Defense Message from the Illinois Attorney General Lisa Madigan and the Illinois Department of Revenue (DOR) An Aurora gas station owner was sentenced to two years in prison for defrauding the state of more than $250,000 in sales taxes. Kane County Circuit Court Judge Marmarie Kostelny sentenced Bhavesh Gandhi, 40, of […]